Collectors, the parent company of PSA, is in the middle of a deliberate power play to reshape the grading landscape into a tightly integrated ecosystem it effectively owns. Recent moves to acquire SGC in early 2024 and to buy Beckett in December 2025 are not isolated deals; they are steps in a consolidation strategy that redefines what it means to be a “major” grader and forces collectors to rethink where they send their cards.

From PSA to a grading empire

For years, PSA dominated grading volume and resale premiums, but it was still one brand among several: Beckett for subgrades and vintage, SGC for pre‑war and vintage aesthetics, and CGC emerging in TCG and modern markets. The acquisition of SGC brought a respected rival under the same corporate roof as PSA, signaling that Collectors was no longer content to compete card by card—it wanted to own the category. By late 2025, news that Collectors would also acquire Beckett effectively pulled three of the four long‑standing “big” names into a single holding company. Public messaging emphasizes that SGC and Beckett will remain “independent brands,” but structurally, they now share owners, capital and long‑term incentives with PSA.

Underneath the brand talk sits a much broader platform vision. Collectors is not only assembling graders; it also owns data and transaction tools like Card Ladder and the Goldin auction house, plus related verticals such as coins (PCGS), video games (WATA) and major hobby events. The result is a vertically integrated stack: authenticate and grade through a portfolio of brands, value items using owned data tools and then sell through owned auction or marketplace channels. This places Collectors less as “PSA plus some add‑ons” and more as the default infrastructure provider for a growing slice of the collectibles economy.

Why consolidation actually helps the hobby

There are real advantages to this consolidation, which is part of why many dealers and investors are cautiously optimistic despite their concerns. First, a larger capital base and shared technology can make grading more efficient and consistent. When multiple brands share imaging systems, machine‑learning tools, logistics and fraud‑prevention infrastructure, turnaround times and quality control can improve across the portfolio. This is especially meaningful at scale, where small operational gains translate into dramatically shorter queues and more reliable grading outcomes for bulk submitters.

Second, concentration of volume inside a single corporate family can improve liquidity and price discovery. When huge numbers of cards flow through PSA, SGC and Beckett under one umbrella—and their population reports, pricing tools and marketplaces are more tightly integrated—buyers and sellers gain clearer comps and more confidence about fair value. A card graded by any of the major in‑house labels benefits from shared data, shared transaction rails and shared marketing, which tends to increase the visibility and tradability of those slabs. In theory, this can make it easier to move inventory, structure trades and manage risk across different sports, TCGs and eras.

Third, a multi‑brand strategy gives Collectors room to segment the market rather than forcing all use cases into PSA. PSA can continue to serve as the flagship premium and high‑volume brand, while SGC leans into boutique, vintage‑friendly or niche markets and Beckett leverages its legacy price‑guide credibility and historical popularity with certain segments. If executed honestly, this segmentation lets collectors choose different aesthetics, grading philosophies or price points while still benefiting from shared back‑end infrastructure and liquidity.

The hidden costs: less competition and more control

The downsides, however, are equally significant, and many hobbyists are already feeling them. The most obvious is that true competition among top‑tier graders shrinks dramatically when three of the main brands share the same owner. Even if PSA, SGC and Beckett keep separate websites, holders and marketing, they no longer have fully independent incentives to undercut each other on price, innovate aggressively against one another or diverge in grading standards in ways that would benefit consumers. Over time, that can blunt the competitive forces that kept fees, service levels and policies in check.

There is also the risk that acquired brands are quietly de‑prioritized once the dust settles. After the SGC deal, hobby chatter and submission statistics pointed to SGC being repositioned more as a boutique presence with less scale, while PSA remained the clear volume engine. This kind of internal hierarchy can turn “independent brands” into mere portfolio slots, where strategic decisions are made primarily for overall corporate optimization rather than for each brand’s community. Beckett loyalists now worry that a similar process could erode the unique culture, grading feel and identity that drew them away from PSA in the first place.

Market power is another concern. As Collectors controls a greater share of perceived “tier‑1” slabs, its decisions around pricing, upcharges, minimum grades, crossover rules, registry policies and submission structure will shape more of the entire market. If alternative graders cannot grow enough scale and liquidity to provide a meaningful check, collectors may find themselves with fewer practical options when they disagree with a policy or fee change. The community’s trust is further strained by the optics of being told brands are “independent” while any major strategic call ultimately rolls up to the same boardroom.

How this shifts submitter behavior

For pure value‑maximizing flippers and investors, the calculus may not change immediately. PSA still commands the strongest average resale premiums and the most robust registry culture, so high‑end cards and key modern pieces are likely to keep flowing there. The fact that SGC and Beckett sit under the same umbrella may even reinforce the perception that the PSA ecosystem is “the” place where serious money lives, making PSA more entrenched in the short term as the default choice for big cards needing maximum liquidity.

However, not everyone optimizes solely for resale, and even those who do may be wary of feeding a single dominant ecosystem. Collectors who value independence, grading transparency or different aesthetics are increasingly likely to look outside the Collectors orbit when sending in certain types of cards—particularly personal‑collection items, niche sports or segments where PSA’s price premium is thinner. This is where independent graders can become genuinely more attractive as credible alternatives rather than just curiosities.

The rise of independent alternatives

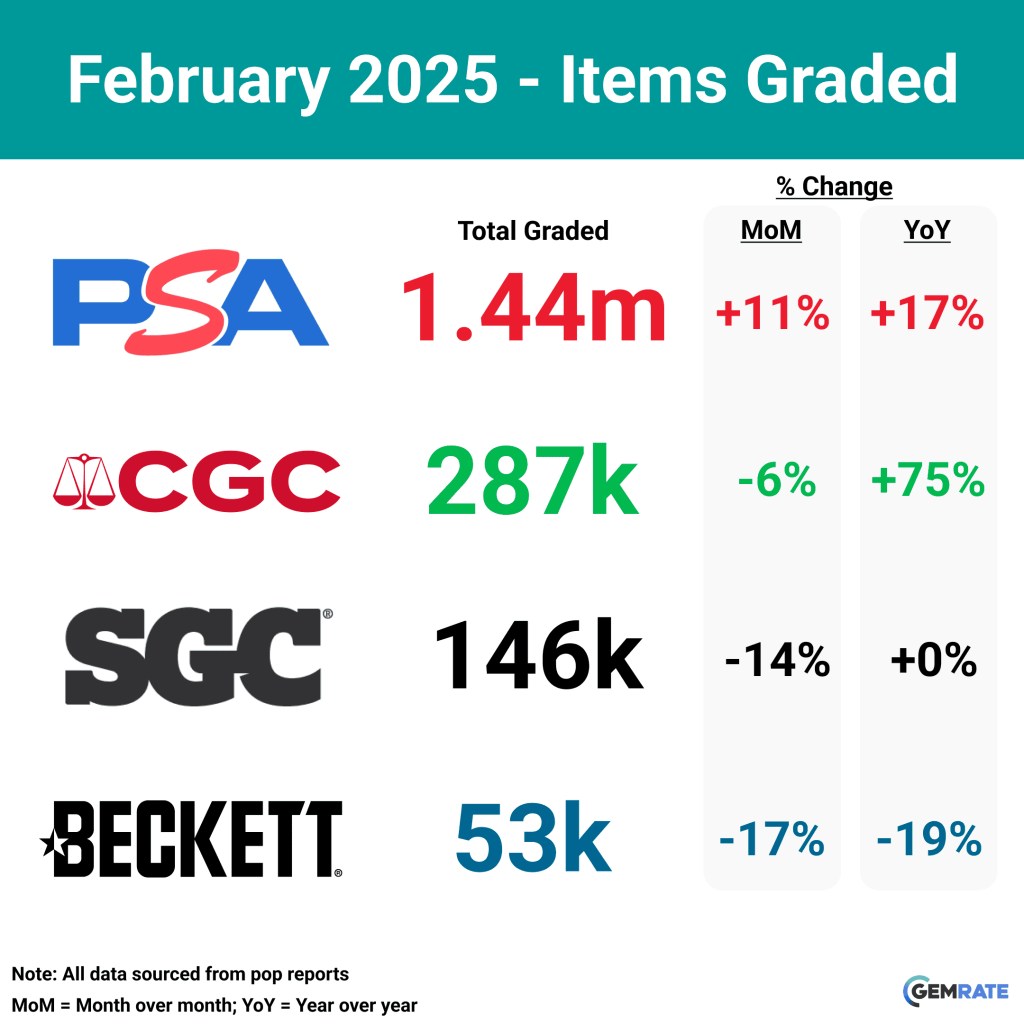

With PSA, SGC and Beckett aligned under one corporate structure, the most obvious beneficiary is CGC. It is the only large‑scale grader that remains fully outside the Collectors family, and it has built a reputation for relatively fast turnaround times, competitive pricing and a modern 10‑point scale with half grades and detailed subgrades. CGC has already been gaining share in TCGs and certain modern markets, and the resale gap between CGC and PSA slabs has been narrowing in many segments. For submitters who want liquidity but dislike PSA’s increasing dominance, CGC naturally becomes the primary “other pole” in the grading universe.

Beyond CGC, several smaller but innovative companies stand to gain attention. AGS and TAG are both pushing AI‑ and imaging‑driven grading models that emphasize consistency and transparency, with highly documented grading reports and automated analysis. This appeals to collectors who value objectivity and detailed feedback over legacy brand recognition. As concerns about corporate control and subjective standards grow, these tech‑forward graders can position themselves as the “science‑first” alternative where the process is visible and replicable, not just a black‑box human judgment.

HGA and ISA operate more as niche players but also become more interesting in a consolidated world. HGA’s focus on hybrid AI‑human grading and highly customizable, colorful labels attracts collectors who care about visual presentation and individuality. ISA, with its more traditional look and accessible pricing, offers a smaller‑scale, independent experience for collectors who want slabs that feel familiar without supporting the dominant ecosystem. While none of these names individually rival PSA’s liquidity today, together they form a cluster of alternatives that gives the community some leverage—especially as more collectors consciously diversify where they submit.

Where the grading market is likely headed

Taken together, these acquisitions are pushing the hobby toward a more mature but more polarized structure. On one side, Collectors is assembling an integrated empire: PSA as the flagship, SGC and Beckett as segmented brands, and a web of grading, data and marketplace assets that make it easier than ever to stay entirely inside one ecosystem from raw card to sale proceeds. On the other side, a mix of independents—anchored by CGC, with AGS, TAG, HGA, ISA and others at the edges—offers a counterweight based on independence, transparency, aesthetics or specialized features rather than sheer market share.

For collectors and graders, the key trade‑off is becoming clearer. The Collectors ecosystem offers convenience, liquidity and a feeling of safety in scale, but at the cost of more concentrated power and less true competition among the most familiar brands. Independent graders offer diversity, innovation and some protection against monoculture, but often with lower resale liquidity and more fragmented recognition. How the community chooses between those options over the next few years will determine whether Collectors’ grading empire becomes an unchallenged standard—or merely one powerful pole in a genuinely competitive, multi‑platform hobby.

Leave a comment